Bioeconomy Corporation Seminar on Sales & Service Tax (SST 2.0)

Tax Alert Grant Thornton Malaysia

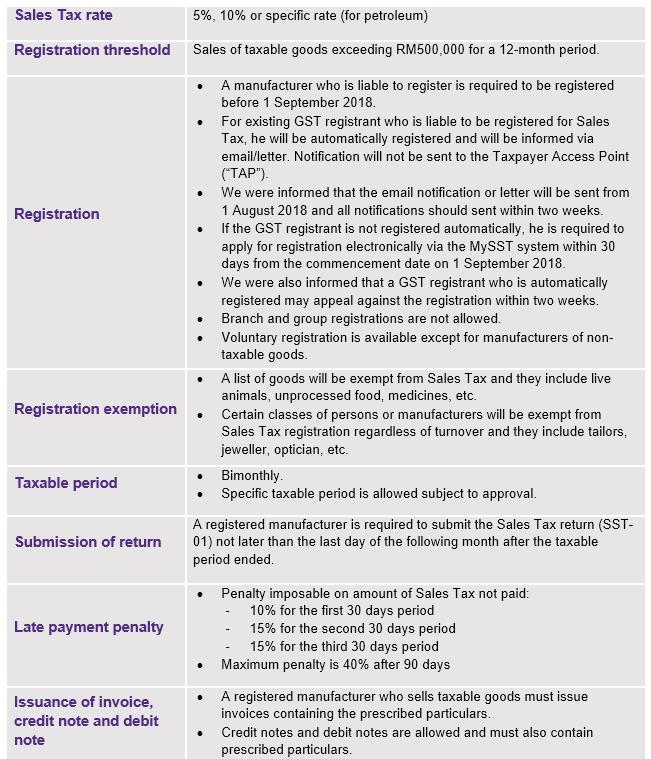

SST: Simplified Malaysian Sales Tax Guide - MyPF.my

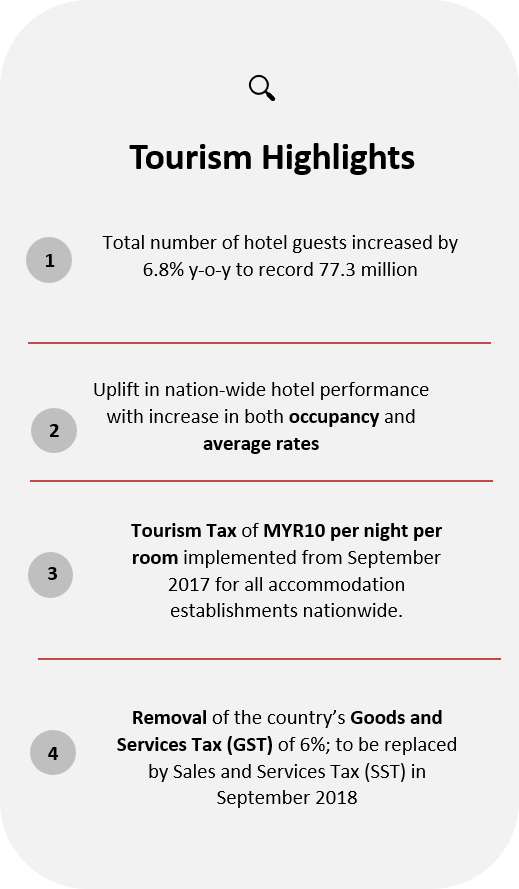

HVS In Focus: Malaysia - Reinvigorated Opportunities

SALIENT FEATURES OF GST MATTA Date :28 April 2014 Place: Vivatel

Dr Salwa on Indirect Taxes Part 1 - YouTube

45 Sales Invoice 8 SST 1 (Exempted Taxable Service) E Stream MSC

Malaysia to impose 5-10% tax on goods, 6% on services - CNA

GST In Malaysia Explained

Shipping to Malaysia: Options to Consider

SALIENT FEATURES OF GST MATTA Date :28 April 2014 Place: Vivatel

Dr Salwa on Indirect Taxes Part 1 - YouTube

Tags:

archive